Ghost workers: Who are they and how to deal with them

Published on: Wed Jun 17 2015 by Ian Hawley

Ghost workers can tap valuable resources. Here is a discussion on how to identify the three different types and how to address the problem.

This is about the phenomenon of ghost workers.

Don’t blame the ghosts; they may be 100% innocent, and they’re certainly not the ones getting rich.

Popularised and often misunderstood. Its a problem for private business, and especially for government payrolls and public financial management (PFM) in fragile and conflict affected states.

This article discusses different categories of ghost workers and how to approach the problem.

By Ian Hawley

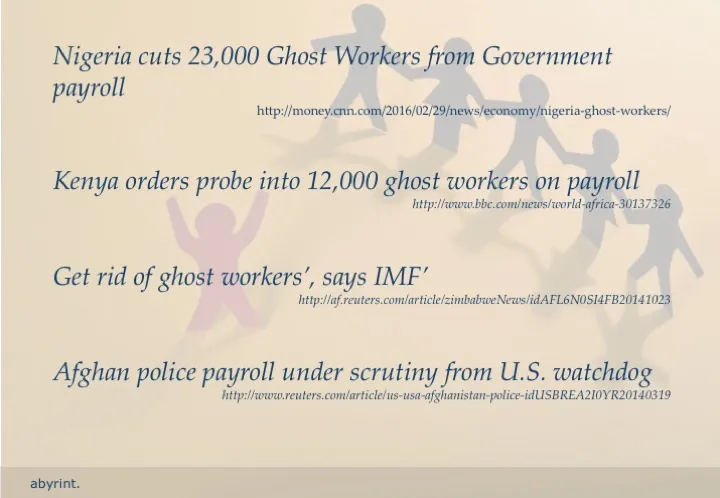

Exhibit 1: Illustration of news of ghost workers in fragile and conflict affected states

The public is tired of hearing it; scarce government funds filling the pockets of corrupt officials; in some cases wasting foreign aid given generously. Stories of ghost workers come to light time and again from countries with weak public financial management and high levels of corruption.

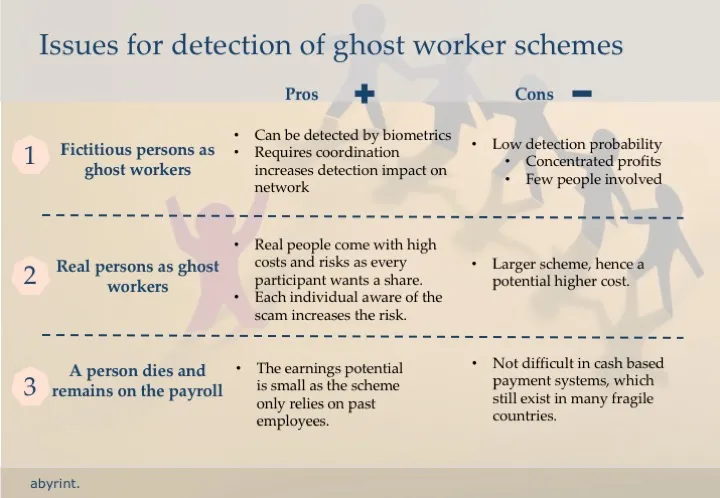

A government worker dies and remains on the payroll; a ghost worker in the most literal sense. Payments keep coming and someone finds a way to access the cash. Not very difficult in cash based payment systems, which still exist in many fragile countries. The payment agent simply takes the money. Perhaps a signature needs to be forged. Who is going to know?

If further controls are in place and involve additional people, the profit may need to be shared. Those in the know must be kept quiet.

But the above is not the large-scale ghost worker problem that makes the news. Waiting for your staff to pass on is not a very ambitious approach to profiting from corruption. The logical next step is to scale-up.

But where do you find appropriate ghosts and how do you enrol them in your program?

Joking aside, this is a serious and widespread problem. Beyond ghostly civil servants and the human resource impacts, and the obvious leakage of public financing and corruption, it is impacting the credibility of the state. It may impact rule of law more broadly. It may impact economic growth and certainly reduces the effectiveness of public spending as it is misdirected. It concerns the agencies of international development. Complex political economy explanations are often sought. In this case, we look at the three key questions.

- Who are the Ghost Workers

- Who is profiting

- What can be done about it

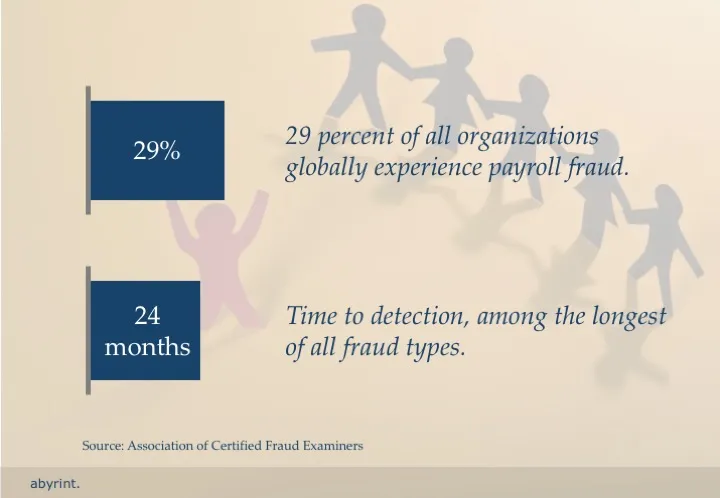

Exhibit 2: 29 percent of all organizations globally experience payroll fraud and they take a long time to detect

1. Who are the Ghost Workers?

Technically speaking a ghost worker, or ghost employee is someone recorded on the payroll system, but who does not work for the organisation. The ghost worker/ghost employee can be a real person, who with or without their knowledge, is placed on the payroll, or a fictitious person invented by the dishonest staff.

A major consideration is whether you have to look for real people to be your ghost workers or if you are able to enrol ghosts with fictitious identities. Real people come with high costs and risks. They will want to profit from their participation in the scheme and each additional individual aware of the scam increases the risk that the wrong people will find out. This could further increase costs to keep things quiet or even put an end to the scam entirely.

Exhibit 3: There are three types of Ghost workers: (i) Fictitious persons; (ii) Real persons; and (iii) Real person leaves/dies but remains on the payroll

All else same it is preferable to enrol fictitious ghost workers. No one to share the profit with, no loose lips, and no one to attempt to increase their share of the pie through, for example, blackmail. However, things are not always easy. Except in the most extremely poor control environments it is difficult to add a fictitious person to the payroll, put them forward for payment each period, and have their salary.

Make no mistake, these ‘most extremely poor control environments’ do exist. In such cases taking advantage of the situation requires less creativity and more vibrato. If the control environment is poor but with basic functionality, the practical way forward will be to use real people.

What type of individuals are you looking to enrol in the ghost worker programme what steps are needed to get them paid?

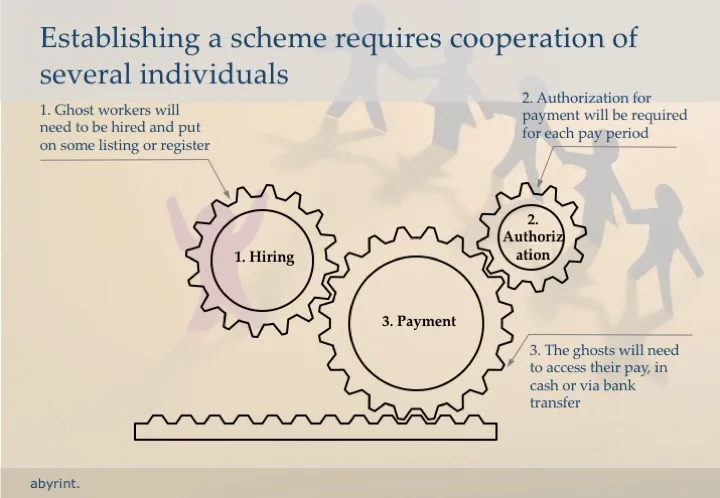

Exhibit 4: Significant cooperation is required to run a scheme of ghost workers

Your ghost workers will need to be hired and put on some listing or register, quite likely some authorization for payment will be required for each pay period, and the ghosts will need to somehow access their pay. In order to get this set up, the cooperation of several individuals may be required. Even when only rudimentary processes are in place, the authority for the following decisions is typically segregated:

- authorisation to hire;

- authorisation of periodic salary payments;

- payment of salary, whether in cash or via transfer to a bank account.

Individuals holding the relevant authority are part of the scheme, either knowingly or unknowingly. Again, the fewer individuals actively involved, the lower the costs and risks.

Exhibit 5: Categorization of ghost workers, and challenges and opportunities for detecting and controlling for ghost workers in organizations

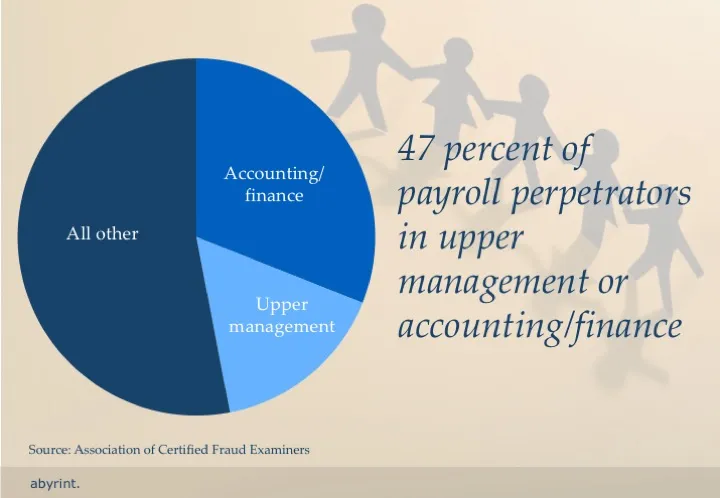

2. Who profits from ghost workers?

While individuals in various positions can be well positioned to organize such a scheme, and to influence those with the necessary authority, a ghost worker program relies heavily on the participation of the person authorizing the periodic salary payments.

Exhibit 6: Benefits of ghost worker schemes are concentrated in upper management and accounting/finance functions

The role played by the ‘Line Manager’ includes a basic control by which payments are only authorized for individuals who are performing work and it would be rare that individuals not performing work would be put forward for payment unwittingly by a Line Manager. Note that while Line Mangers can take decisions on their own, in weak control environments there are also low barriers to Line Managers being directed by more senior officials.

In schemes build around the Line Manager’s authority, there are variants as to who else needs to be involved to make the scheme a success. The most common accomplices to the Line Manager are those making the actual salary payments and people involved in the hiring process. With all of these bases covered, the internal controls face a formidable challenge.

Remember however, the more people involved, the higher the costs and the risks. Does a savvy Line Manager really need the cooperation of others?

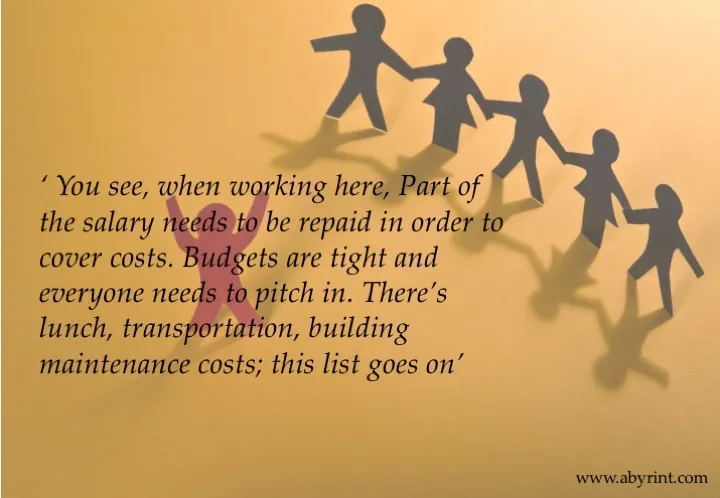

Hiring ghosts can be difficult, in addition to requiring the cooperation of someone authorized to hire, budget caps on staff and hiring processes can create barriers. As for the involvement of payment agents, this is not necessary when the workers themselves pick up their salaries, and then diligently pay their ‘contribution’.

As the Line Manager you start by explaining the situation to your staff, or if you are less bold, to just some of them;

Exhibit 7: Illustration of motivation for ghost worker kickback schemes

Staff will pay, and some may even find it legitimate. In some cases such collections are legitimate. While clearly poor practise, a lack of transparent rules leaves room for interpretation and creates a situation of uncertainty, ripe for opportunists. Those who question the legitimacy of a request to pay part of their salary must consider their options. Even if the situation is unfair they will likely conclude that part of a salary is better than none. In countries with weak rule of law, the consequences of dissention can go beyond loss of income.

Under this ‘Line Manager alone’ approach no collusion is required between those with authority. Only the cooperation of the workers required. Nothing needs to be forged and there is no paper trail. Cash can simply be collected the day after pay-day.

Desperation on the supply side of the labour market and the consequences of weak rule of law will come to bear on people’s tolerance to participate in such schemes. These same factors drive the decisions of corrupt officials to engage in such activities.

3. What can be done?

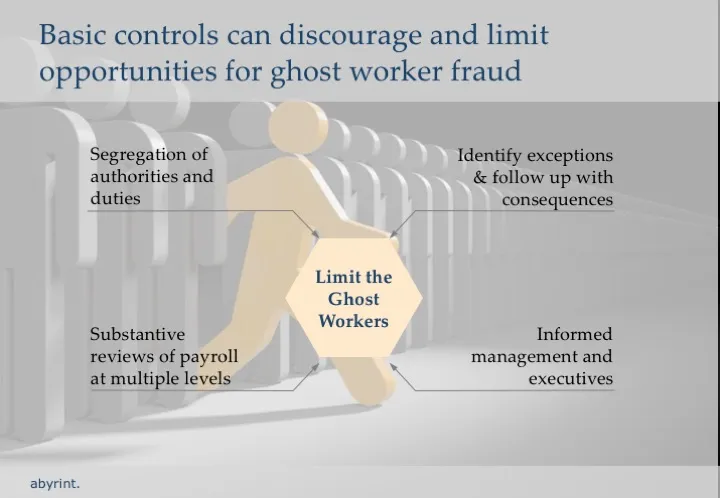

Basic controls can discourage and limit opportunities for ghost worker fraud. Segregation of authorities and duties, substantive reviews of payroll at multiple levels, and informed management and executives can go a long way. These principles are the same as for general public financial management and budget execution. Controls are useful however only if operated effectively. Control effectiveness requires a reasonable expectation that exceptions will be identified, and consequences will follow.

Exhibit 8: Four key controls to reduce ghost workers and improve public financial management

There is no magic bullet. Effective financial control requires a reasonable control environment. Procedures and transaction level controls can otherwise always be bypassed, in particular in environments where there are low barriers to collusion and weak rule of law.

Exhibit 9: Challenges of establishing effective ghost worker controls in a fragile and conflict affected state

Ian Hawley is a Partner with Abyrint.