Value Chain Analysis in Public Financial Management (PFM)

Published on: Sun Jun 21 2015 by Ivar Strand

When analyzing complicated systems, like the public financial management system of a country, it is helpful to break the subject matter into smaller pieces. These subsets can be analyzed and handled one at a time. You can eat an elephant, but only one piece at a time.

At the same time, it is important to understand how the parts connect and form a larger whole. It is also important to be able to communicate how it all relates to decision makers and stakeholders.

For this purpose the time-tested technique of identifying the value chain is very helpful. Value chains depict how several activities delivers results and relate together. It can be used very similar to a process-chart, but at a higher level of aggregation. The public financial management processes, including those in fragile and conflict affected states, are very well suited for a value chain approach.

A government budget execution is a process that follows a sequential logic. It is almost like on an assembly line. PFM systems are also extremely transaction intensive operations. It is a repetitive business whereby the same actions are performed over-and-over again, by the same entities, and by the same people.

Here is a guide for how to approach a value chain based analysis of the treasury value chain whether it is in developing countries or elsewhere.

1.Define the overall framework

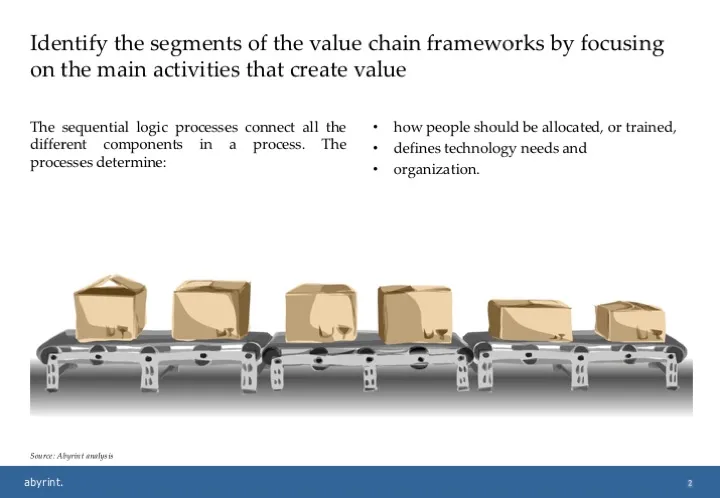

A value chain model is defined by the activities involved in delivering a result. All these activities, when organized in a sequential manner, define a work process for that particular activity.

It’s the work-processes that connect all the different components. In this perspective, it’s the processes that determine how people should be allocated, or trained, defines technology needs and also impacts organization.

Thus, the key is to identify the main activities of the value chain and put them in the right order.

Exhibit 1 The assembly line logic of a treasury system value chain

2. Define the elements to include in the public financial management analysis

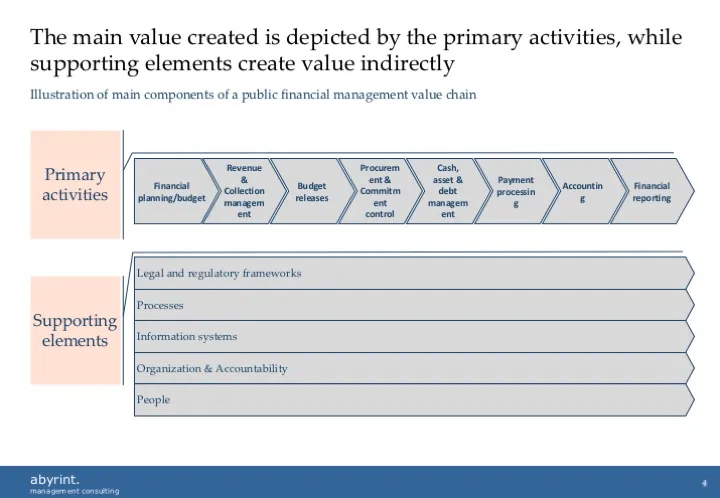

There are two types of activities to include:

- The primary activities, and

- The supporting activities.

Start by identifying the primary activities of the public financial management process. These are the activities that directly add value to the outcome.

2.1 Defining primary activities in the public financial management process

There are two issues to consider when defining the primary activities:

First, determine the scope/length of the process chain. What defines the starting point – and the end point? Depict the process end-to-end and to ensure that all major issues and interfaces are captured.

Some practical judgement is needed. Especially when it comes to prioritising where research and analytics are required.

For example, while the payment arrangements is a logical extension of the payment authorization process, should this be included in a PFM value chain? The answer could be yes in situations where Central Banks perform payment functions for governments, and payment/banking issues are part of the underlying problems. In other situations, many corporations that restructure their treasury operations don’t address the payment issues directly. The payment issues are fully “pushed put” to commercial third parties/banks. There may be questions about how to optimize the arrangements, i.e reducing banking fees, but they would not head-on address the technical problems.

A rule of thumb when identifying these primary activities is to search for at least three main types of activities:

- First set of activities are about the input flow. How does inputs or information start the process? For PFM issues this is usually the budget/planning. Collection of revenue is possibly also early in the flow. The analytical questions in this area are mostly about how the inputs flows are structured and received; and

- The next set of activities address the value added processing steps whereby the institution processes the information and acts on it. This can include authorization of payments and cash management. These steps are very complicated and could easily be depicted as complex processes in their own right; and

- Finally, the activities related to outputs which in this case would include the payments, the accounting and reporting.

Second, there is a question of detail, i.e how many segments should be included and how should they be defined. This question also needs to be determined by the scope of the project at hand. A practical tip is to divide the functions at least by their institutional ownership.

For example, the budget preparation is managed by a different line than the revenue collection. Analyzing these as “one” logical entity may not yield much actionable insight or be practical to act upon.

On the other hand, complex activities may need to be bundled. In the example below, the procurement function is bundled with commitment control. Both activities are in themselves very complex, but for the project where this example is from, the focus was on commitment control and else on procurement.

Exhibit 2 Illustrative public financial management value chain

2.2 Define the supporting factors

Finally, on defining the supporting elements. These represent the areas where you can actually impact the outcome. In the consultants mind, you are changing the capability of the organization/system. Capability drives the performance. The supporting elements are the actual building blocks that needs to be aligned with performance requirements.

The minimal short list for remembering key areas of change include Process, Technology and Organization. (PTO) If you remember these three you will do fine.

Note that in many PFM systems, process and technology will be very intertwined (though be aware that there will always be processes not fully supported by technology, or interfaces between them).

Also, interpret “organization” in the broadest way possible, to be about both roles & responsibilities, as well as about people skills needs.

There are other key issues that are wise to consider, and especially for public sector, the legal and regulatory reform aspects are frequently a part of the change package.

Analysing the supporting elements is a very rich topic that needs much attention but is not explored further in this article.

3. How does a PFM value chain compare to a traditional budget execution cycle analysis or a PEFA assessment?

There are many similarities with these other techniques. All illustrate a sequential logic of the process, and they focus on the main results form each step. Some prefer to depict this as a “cycle” while value chains illustrations are usually presented as linear.

For examples, the PEFA assessments supported by DFID, IMF World Bank and others are often used. The PEFA framework is designed to analyse the main steps in the budget execution process. It covers key steps like public expenditure, asset management and internal controls.

Value chain frameworks may allow for more granularity to be depicted. A value chain analysis very practical as by focusing on the supporting elements for each step – you will identify what is not working and more easily identify solutions. A budget execution cycle analysis is often represented by four to five main elements. The tailored value chain approach is simply more finely grained and it considers explicitly the supporting elements. Whether or not the PEFA budget execution “cycle” is depicted as a circle or as a linear figure makes of course no substantive difference.

PEFA is fundamentally different in that a PEFA assessment is a maturity analysis. Thats an analytical technique where features of the system is compared against a certain standard that have been decided by those that developed the framework. Maturity analysis is used in many sectors to benchmark the performance of systems. For example, for PEFA, the qualities of the budget preparation is compared against a definition of what constitute a strong, medium or weak process. PEFA is a publically available tool developed by financing agencies and the World Bank. The data from studies of participating nations states are also made public on the PEFA websites. In this perspective, the maturity analysis can be a helpful addition to the overall analytics.

The type of value chain analysis discussed here is a tailored technique. It will yield more relevant, tailored and fit-for-purpose results. But, it is much more difficult to do well. If a tailored analysis is performed first, executing a PEFA assessment will be very quick as data and insights are already established. You may find that the PEFA framework does not focus on all relevant elemements for your case, or that it doesn’t deal with them in the same depth. You may also find that PEFA focuses on elements that are less relevant for your problems. Thats the tradeoff between a tailored framework and a global standard.

While PEFA is often used as the primary diagnostic tool for PFM reforms, it may be advisable to also use tailored analytics to ensure that the analysis is fit-for-purpose. PEFA is a generic tool. However, the benchmarking against other countries, and/or over time may yield useful information and may help guide reformers.

Here is an example of a tailored PFM value chain analysis in Somalia.

Here is an example of a PEFA analysis for the same country, Somalia, to contrast and compare against the tailored analysis.

4. How to use the value chain in a public financial management reform process?

The overall objective is to depict the system in a way that helps analysis and engagement so that real change can be impacted. There is no other purpose.

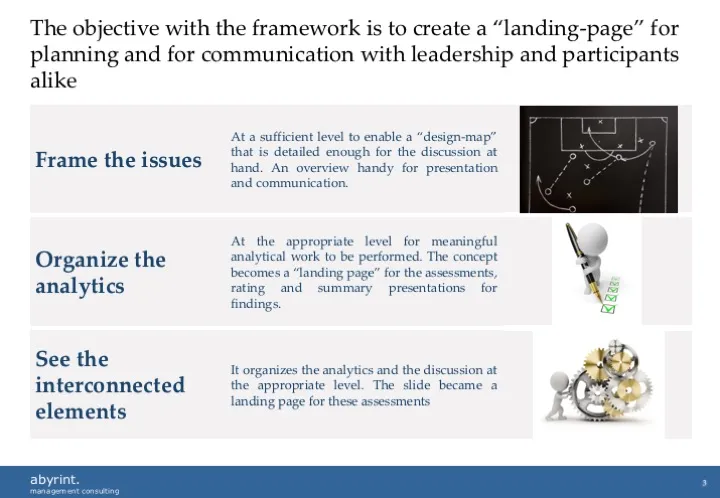

There are three main objectives related to this:

-

Depicting the process as a value chain helps frame the issues. It enables a type of “design-map” approach whereby the main actions/processes in the treasury are visualized in a coherent whole. It creates an easy to understand overview handy for presentation and communication. And as the process moves on, there will be much communication to start moving on all the changes that should take place.

-

It structures the analytics. The main analytics would be organized along the same elements and you would write the research plan accordingly. The slide becomes a landing page for these assessments, some of which can be quite complex in their own right.

-

The value chain will assist in seeing the interconnected elements. It’s a simple conceptualization, but it brings in many of the supporting functions (bottom of figure). The illustration below is used as a starting template for many organizations and is actually bordering on being an “operating model framework”, another favorite tool in the strategy consultants toolbox. Such illustrations are useful for broader and higher level discussions, but the purpose here, was chiefly to focus on the processes and their supporting elements.

Exhibit 3 Advantages of using a landing page

Performing the analysis is another story. This may require access to data from financial accounting systems. Getting reliable public financing and management information data in fragile and conflict affected states is difficult but important. A fragile state cannot afford to go wrong. Decision makers should have access to fact based analytics even if it is difficult to establish.

Happy for your comments and experiences on how to best conceptualize engagement with PFM value chains analytics and reforms!

5. Examples of public financial management analysis

To see a case of how the analytics were applied to a strategy formulation:

- Find the analysis for the public financial management reform strategy for Somalia here (external link)

- How the financial management system analysis of Somalia was subsequently articulated into a policy and action plan (external link)

- Short form presentation of the financial management action plan in Somalia (external link)

- A PEFA assessment for Somalia public financial management system to compare against the value chain analysis (external link)

By Ivar Strand and Magali Van Coppenolle @abyrint.