Optimizing Procurement Policy for Public Sector Efficiency in Developing Economies

Published on: Sun Jun 21 2015 by Ivar Strand

Three ways to do procurement policy differently:

Drowning in data, but still, most procurement policy is not formulated based upon quantitative analysis. This is especially true in developing countries. What can be learned from digging into the data treasure throw and how can this lead to better policy?

Here is one idea: Information about the size and frequency of contracts could inform decisions of threshold levels, design of procedures and risk management strategies.

Procurement is an area dominated by legal and engineering professions, compliance requirements, and there is little quantitative analytical basis Purchase-to-pay systems are among the most complex systems found in any organization. They start with purchasing, go through the treasury and eventually result in payments made through the banks. Purchasing may comprise 20-30 percent of all spending (E.U data).

It’s a data rich area, as every tender, contract and payment leaves bread crumps in administrative datasets, even in fragile states. From time-to-time the data can be pulled and analysed. Some do just that and its called “spend” analysis. In private sector, this is often done to guide optimization of purchasing behaviours, i.e aggregate purchases in bulk.

Yet, in the public sphere, where policy and rules are more important to guide behaviour, surprisingly little of procurement policy is informed by data, especially in a developing country. Indeed, we have yet to see a law or a regulation in a developing country designed based upon data analysis inputs. Please prove us wrong.

There are some exceptions, including extensive and deep data work for the European Union, across thirty EU countries and two million contracts undertaken by myself while working with colleagues at PwC and London Economics. Those studies are in the public domain and we are free to show to them. Hopefully, there are others, and we will be paying attention.

There are good reasons for a legal and compliance focus in procurement. It is also understandable due to the complicated regulatory instruments, yet, it is not enough, and there is no excuse for not approaching the field more empirically.

Use data to set threshold levels, design procedures and risk management strategies There is a close relationship between threshold levels, procedure design and risk management strategies. Formal threshold levels have a huge impact on the procurement process and outcome. Purchasing above certain levels is obliged to follow more stringent rules that involve more transparency and compliance requirements.

While these are important objectives, compliance to procurement rules also come at a very high cost. Preparation costs have in some instances been found to be very close to the total value of the contract for purchases around the threshold levels. Also, the time from tender to contract can also surprisingly high and much of this is driven by compliance requirements. The timing has an opportunity cost and also a direct cost as suppliers will price in a higher uncertainty.

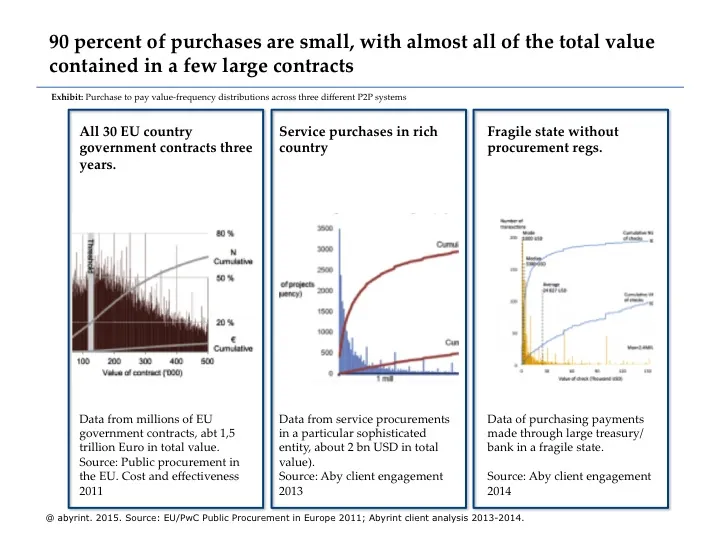

Putting this into practice: Digging into deep operational and transaction data is always fascinating. One phenomenon we find over-and-over again is that the frequency-value distribution of transactions is almost always very skewed. In fact, I have yet to find a dataset where it is not. It is skewed in the sense that most transactions are very small, and a few large transactions contain almost all the value. Organizations grapple with how to deal with this.

Each of the examples above exhibit similar patterns. They are from three wildly different organizational systems, in different places in the world, and at the extreme ends of high-performing versus collapsed state environments. (i) Purchasing across EU 30 countries and nearly 2 million contracts, (ii) Grants and foreign aid services contracts in a highly sophisticated entity; and (iii) Purchasing in a fragile state (that interestingly doesn’t have any procurement procedures).

The patterns exhibit an intriguing uniformity; across the world, across different types of organizations. The values differ much between countries, but the pattern is consistent.

It is quite consistent to see 80 percent of all value being related to the top 10-20 percentage share of contracts. Correspondingly, most purchases are very small, that is as much as 80-90 percent of purchases only add up to about 10-20 percent of all value. What do we make of that?

The question Since these levels have such an inordinate impact on the procurement system, an important question becomes how are they determined and can it be done better?

There are mostly three traditions for determining the threshold levels in a procurement framework, which we, paradoxically, cannot quantify:

1. Its WTO. As part of the trade framework there are also a general procurement agreement (GPA) negotiated a few decades ago, and while not very prescriptive, it has an influence on threshold levels to ensure tendering and open markets across borders. The levels determined by the GPA are negotiated, not very empirically based, but for all practical purposes, no-one wants to renegotiate this as it may open a pandoras box of other issues. However, this is only relevant for OECD countries and some friends. Very few other countries have signed up.

2. It’s the World Bank. They have an inordinate influence on procurement policy formulation and threshold levels in developing countries. To our knowledge, not based upon empirical studies of what works. At least based upon the gut feeling of a procurement adviser in an international organization. There is possibly some experience basis for the gut feeling but it is rarely documented.

3. Negotiated in country.

Rule following today requires use of complicated decision trees and matrixes as there are many levels and procedures determined by them. Countries also set other procurement levels additional to, and below, the international levels. Levels may also differ between type of purchase, i.e most countries have higher levels for works than for services and goods. Levels may also differ based upon government entity, i.e utility, central or local. In the World Bank procedures, de facto modelled for many client countries, there are also different levels for different types of services, i.e consulting versus other services.

One would wish that these policies, the levels, and the corresponding complexity of regulations had a basis in an understanding of what works. Unfortunately, this is rarely the case.

The resolution is to set levels and design procedures based upon balancing needs for transparency, competition and efficiency It’s a complicated topic and one could possible write books about this. The simple point here is that the design of procedures and threshold levers is rarely based upon empirical foundations.

Rules for procurement in many countries are trying to balance different concerns, i.e compliance, corruption, transparency, possibly functionality, but, rarely efficiency. We will not resolve this once and for all here, but here are some thoughts just based upon the patterns observed above.

Looking at the figure above, a few questions can be asked:

- Where is the highest risk? Is it for the few, but very large contracts? If so, we need strict rules up there.

- Where is it most important with consistent and efficient execution? In the 90 percent of small and repeat transactions?

Effective approaches to dealing with risk, quality and execution can be very different depending upon whether it is a small or a large transaction. Yet, in most policies and guidelines, especially in government, there is little meaningful distinction, except perhaps even more stringent controls for the largest transactions.

An implication is of course that it would be rational to try to minimise the transaction costs of these high frequency and low value transactions. Indeed, some do just that. Extreme cases are Amazons’ warehouses. But, available solutions may be very different in public financial systems with multiple distributed actors and with rules and procedures being motivated by a number of factors, of which efficiency, may not be on top of the list.

So what does this mean for decision makers?

- Increase efficiency: Most advisors would recommend reducing the marginal transactions costs. Lets call it the Amazon strategy. Design simple rules and regulations suited for high frequency low value transactions. This will save on processing time, training cost and control cost.

- Larger contracts: Reduce the transaction frequencies and increasing the value of each contract. In public procurement, this takes the shape of larger contracts or, as the trend is, framework contracts in the EU or indefinite purchasing arrangements in the U.S. aggregation of demand. This comes with a whole set of other problems, including closing the markets for non-incumbents and cutting out SMEs. A trade-off the EU is taking very seriously in their deliberation of new procurement directives.

- Flag high value contracts for risk management. From a risk management perspective the balancing is not very clear cut. Most risk systems flag high value transactions and pay extra attention to them. Modern approaches to anti-money laundering and sanctions compliance however do not necessarily distinguish. Executing a payment to a bad guy today will penalize a commercial bank disproportionally, almost regardless of value. A risk management approach may need to consider both aspects of the risk equation (probability*impact). Impact is higher in high value fraud, but not necessarily the probability.

Fraud may just as easily, and perhaps more easily, happen with small value transactions. And remember, most transactions are small.

The dilemmas are many. We don’t have a robot to figure this out quite yet, but we do have data, and we could be using it.

@ivarstrand partner @abyrint